• Judging from the markets, President Trump has embarked on the biggest economic gamble any president has ever made. In other words, Trump is betting his presidency.

• Of course, maybe we shouldn't judge things just by the stock market? When markets started falling in 1981 after Reagan's tax cut plan passed and went into effect (correctly anticipating that a recession was beginning), a reporter baited Reagan by saying that Wall Street didn't seem to like his economic policy. Reagan's response: "I've never found Wall Street to be a very good source of economic advice." Boom!

• In this regard, I am also reminded of Churchill's line from the 1920s: "I would rather see finance less proud and industry more content." Sounds a bit like Trump and working-class-focused Maganomics. Churchill made this comment in the context of his decision, as Chancellor of the Exchequer, to return Britain to the gold standard at the pre-World War I exchange rate (Britain had suspended its gold backing for the Pound Sterling during the war), which was out of whack with post-war international currency valuations. There is considerable myth to Churchill's role in this decision, as it was always planned for Britain to return to the gold standard at some point, but the exact timing and valuation were not determined. Churchill yielded to the importunings of the Bank of England chair Norman Monatgu, and later regretted his decision, once saying he wished he could "hang" Montagu. John Maynard Keynes's comment from the time (in his essay "The Economic Consequences of Mr. Churchill") finds an echo just now: "What now faces the Government is the ticklish task of carrying out their own dangerous and unnecessary decision."

• It has been fashionable in the run-up to Trump's tariffs for defenders to revise the conventional wisdom that the Smoot-Hawley tariff of 1930 was a leading cause of turning a recession into the Great Depression. Drawing on the work of Milton Friedman, the revisionist view says that it was bad monetary policy that is primarily responsible for making the depression Great. This point is correct, though there was likely a relationship between monetary factors in the U.S. and trade instability, and it does not absolve Smoot-Hawley of having catastrophic effects. How catastrophic? I dusted off one of my favorite economic histories, Jeremy Atack and Peter Passell's 1994 A New Economic View of American History, for their account of Smoot-Hawley. Here is the relevant part, some of which ought to sound familiar this week:

The other force affecting foreign trade was a renewed spirit of economic nationalism. Initial agitation for tariff protection came from the ailing U.S. farm sector, but as the Smoot-Hawley Tariff legislation moved through the House and Senate, its coverage was widened, and the level of protection increased. . .

In manufacturing the duty on cotton textiles was raised from 40.27 percent to 46.42 percent, notwithstanding the fact that the current troubles in the industry were the result of competition between New England and southern mills rather than between domestic and foreign. [Comment: you can swap out "auto industry" for textiles here, and capture the dynamic of our domestic auto industry between union states like Michigan and non-union states like South Carolina.]

A contemporary British economist at the time [Sir Arthur Salter] described ratification of the tariff as "a turning point in world history," for it brought with it the collapse of the international gold standard. Primary product prices were driven down, and primary producers, such as Australia and Argentina, were the first to be forced to abandon the gold standard. For the United States it brought temporary relief, but at a very high price. The U.S. balance of payments shifted from deficit to surplus, the stock of monetary gold increased, the trade balance did not decline very much, and prices in the United States fell less in 1930 than in outer countries. Not until the following year did prices in the U.S. fall faster than those abroad.

Retaliation by other countries to the Smoot-Hawley Tariff followed almost immediately upon its adoption and brought with it the collapse of world trade. American exports fell faster than imports as the rest of the world jockeyed for a competitive edge via tariffs or other trade restrictions. Whereas in 1929 U.S. net exports had amounted to $842 million, by 1933 they were only $225 million or about one-third the pre-tariff war, pre-depression levels of trade.

By golly, looks like Ben Stein was right after all:

• Thomas Sowell: “Oh my gosh, an utter disaster. I happen to believe that the Smoot-Hawley tariffs had more to do with setting off the great depression of the '30s than the stock market crash. Unemployment never reached double digits in any of the 12 months that followed the crash of October 1929, but it hit double digits within six months of passage of Smoot-Hawley, and stayed there for a decade. . . . When you set off a trade war, like any other war, you have no idea how that's going to end. You're going to be blindsided by all kinds of consequences. You do not make America great again by raising the price to Americans, which is what a tariff does.”

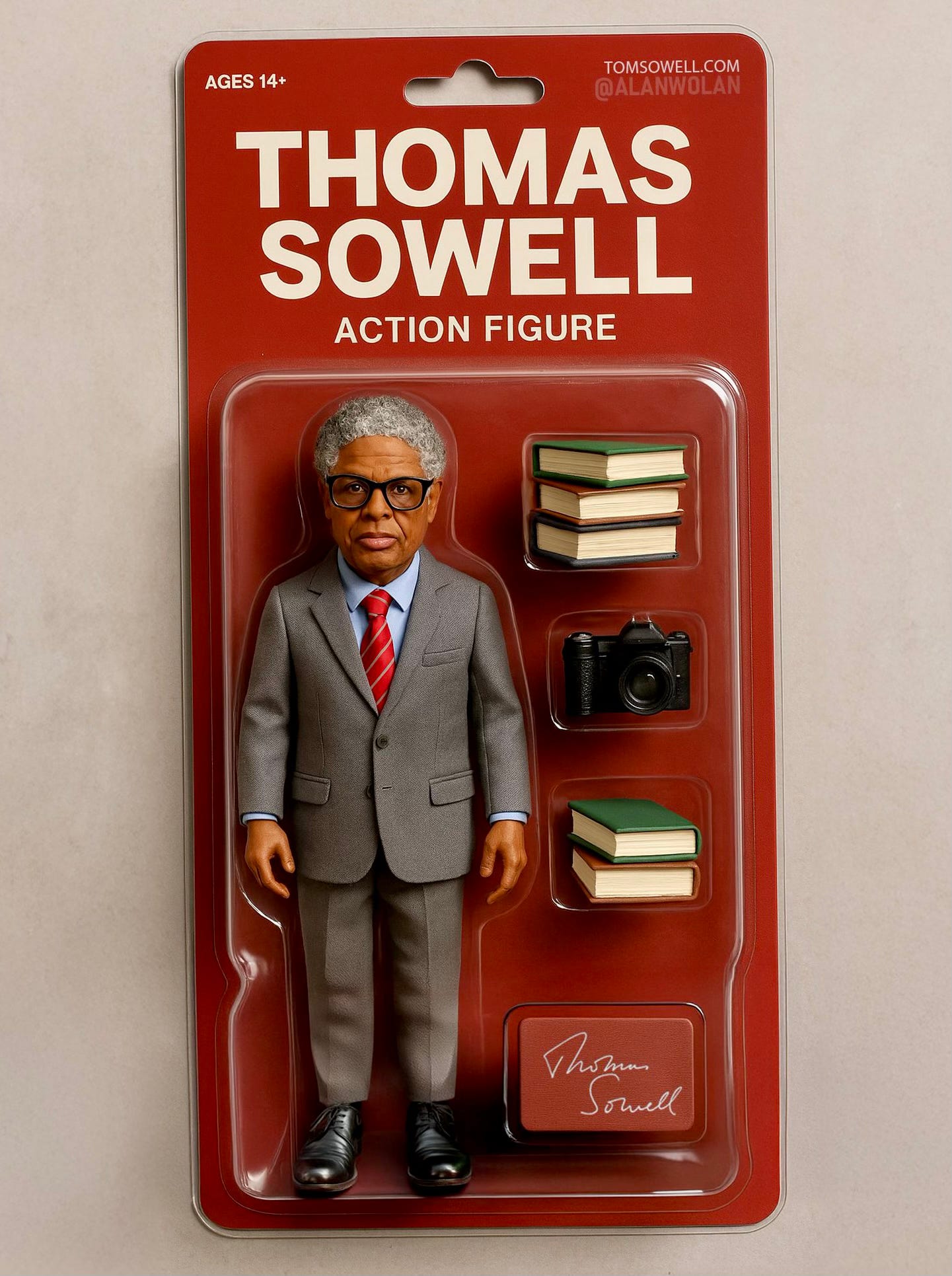

Meanwhile, I want one of these:

• My Twitter/X provocation of the morning:

Looks like I spoke too soon!

NCLA (New Civil Liberties Alliance) are the good guys, founded by the great Philip Hamburger.

• Maybe this is more of Trump’s legendary 3D chess? He’s got Democrats coming out against tax increases and for free trade! And maybe his own staff made these tariffs so irrational that it will kill off trade protectionism, or make Congress limit the president’s unilateral power to make such sweeping decisions?

• Well, we might as well go into the weekend with some meme-generated mirth!

Concerning the graph of How Couples Meet... I assume it's a joke. Without my bothering to give my half-axed attempt, well somebody just carefully explain it to me. Forget that jokes need no explaining! Sometimes SH's do!

I'm shaking my head as all my favorite economists throw up their hands at Trump's tariff moves. Tariffs themselves are simple transit/transaction taxes, no different than sales or value added tax. Protectionism is when tariffs are used to meddle in trade, either by nation or by industry. A tariff could be a better way to finance government than an income tax, if it was a flat rate levied equally. Using the word tariff as a shorthand for protection is confusing to all.

Smoot-Hawley raised fees above other nations, from 40% to 46% as noted, while Trump raised them from 2% to be half the level of most others. That's an odd way to start a "trade war." We've only seen the beginning of the negotiation; the end result may be lower tariffs overall. Nations are already responding by offering lower tariffs, such as Argentina and Vietnam. Recall that Adam Smith ended his illustrious career as head of Scottish Customs, collecting tariffs.